Galloping into 2026: Singapore’s Residential Market Powers Ahead

2025 is shaping up to be an interesting year. Pivotal events such as the “Liberation Day” have led to an intensifying trade war, driving heightened geopolitical risk. But the saving grace lies in the lower interest-rate environment, following the Fed's successive rounds of rate cuts to manage inflation and boost employment rates. This has continued to support liquidity and risk appetite globally. The writing is on the wall: we are likely to see deeper structural shifts in global trade and capital flows as economies adapt to new geopolitical realities in the medium to long term.

Despite the underlying headwinds, Singapore’s economy and financial markets have shown remarkable resilience, charting their own path. The optimism has extended to the Singapore residential market, which has notched its strongest performance since 2021, recording commendable sales volumes. New home sales in the first ten months of 2025 have surpassed 10,000 units, while secondary market transactions remained steady at around 12,000 units over the same period.

But the bigger question remains, can this momentum sustain through to 2026, and what new forces are expected to shape the market in the year ahead? In the true ERA spirit, let us share our outlook for 2026 as we gallop into the year of H-O-R-S-E, a perfect metaphor for momentum and strength expected for the residential market ahead.

Homebuyers shifting from HDB to private market as rules tighten

From the increase in Build-to-Order (BTO) supply and the Housing and Development Board’s (HDB) reclassification framework, to the lower HDB loan quantum and the latest move towards the Voluntary Early Redevelopment Scheme (VERS) from the Selective En-bloc Redevelopment Scheme (SERS), all these measures point to a common message. That is, HDB is seeking to moderate resale price growth and guide the market toward a more sustainable pace of price appreciation.

For the most part, the tightening of rules has seen positive effects on the market. For instance, in the first nine months of 2025, the HDB Resale Price Index grew by an average of 1.0% quarter-over-quarter (q-o-q), moderating from 2.3% during the same period in 2024.

One may argue that the number of million-dollar HDB flats continued to climb in 2025, with 1,336 units transacted in the first ten months, already surpassing the 1,035 units recorded in the whole of 2024. Still, the upcoming reclassification framework may help further moderate price growth over the next decade, as Prime flats gradually enter the resale market. Constrained by the resale income cap and subsidy clawback, Prime flats are unlikely to see runaway prices like newer, centrally located resale flats. Instead, they are more likely to experience a more measured and sustainable pace of price growth over time.

Additionally, once the VERS programme is implemented, the HDB resale price trajectory may also moderate further, reinforcing a more stable and equitable housing market reflective of the balance lease tenure in the long run.

In the long run, HDB flats will continue to offer value-for-money housing options, but the likelihood of significant capital gains may taper off. For those looking to capitalise on better future price growth, the private home market may offer more promising upside potential, and here is why.

Ongoing rise in land costs keeps home prices resilient

Over the course of 2025, overall land costs have risen noticeably, albeit at varying paces across different market segments. This trend was largely underpinned by the steady decline in unsold inventory. In simple terms, the strong take-up rates at recent launches have further reduced the pool of available units for sale, leaving some developers with depleting stock and a growing urgency to replenish their land banks.

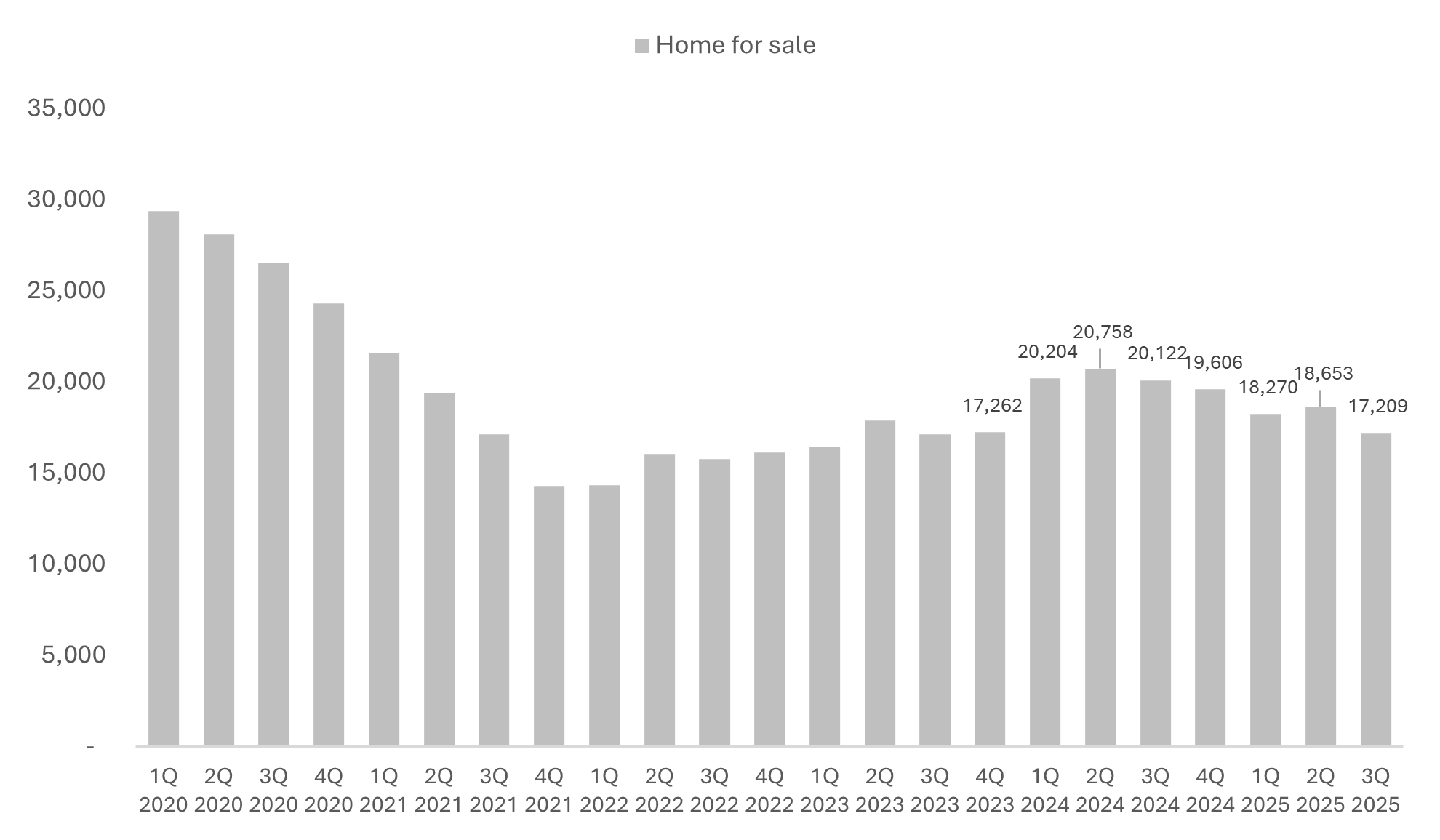

Chart 1: Unsold stocks in 3Q 2025 fell to its lowest since 4Q 2023

Source: URA

Unsurprisingly, as more developers gravitate towards sites with strong locational attributes, land prices have continued to edge upwards.

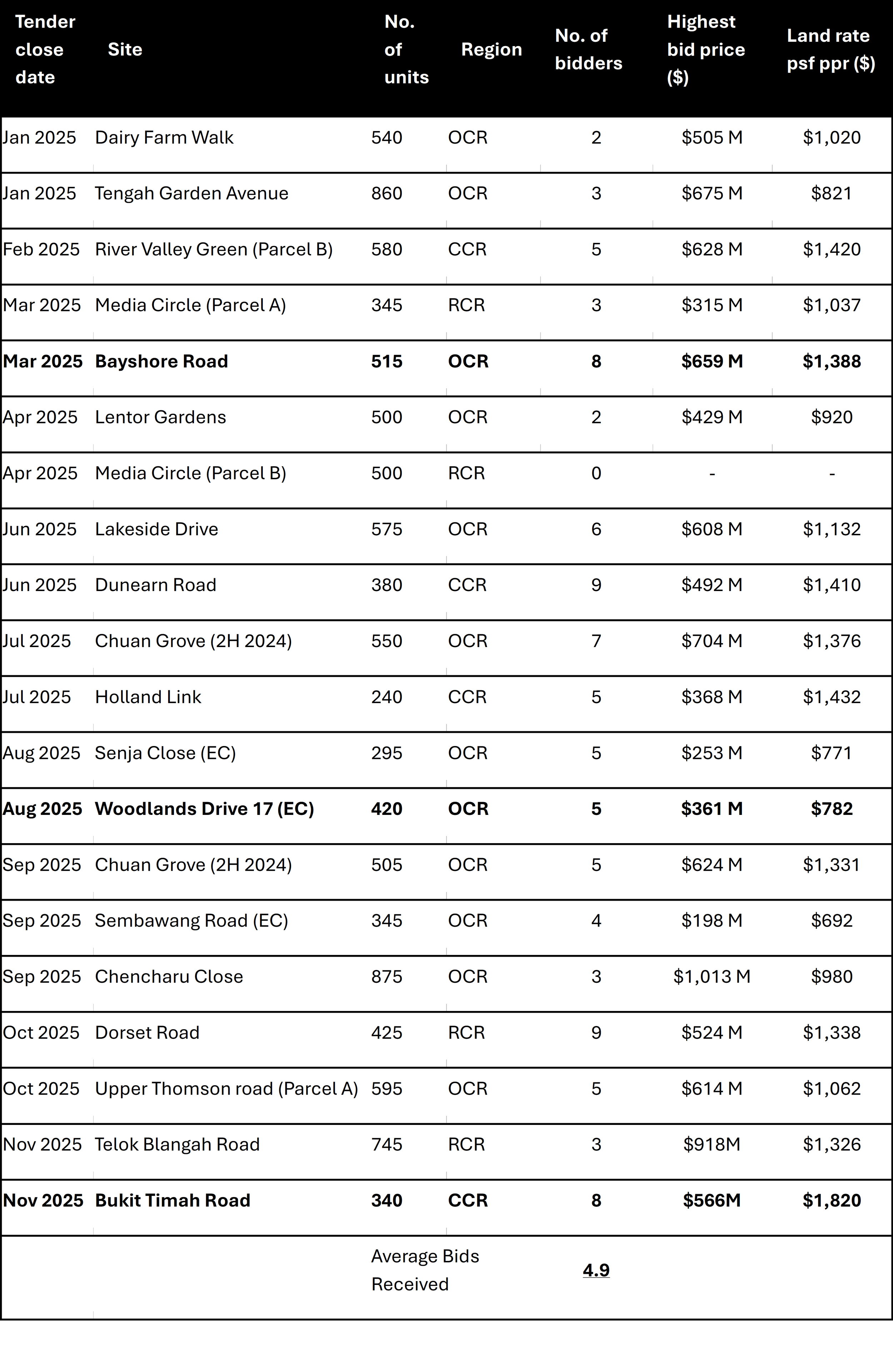

At the same time, the release of the Draft Master Plan 2025 has unveiled new housing opportunities across the island. Emerging residential precincts such as Bayshore Road have attracted heightened interest and competition among developers. Consequently, several sites in the Outside Central Region (OCR), including Bayshore Road and Chuan Grove, have set new benchmark land prices in the process. Taking it all in, the higher land costs have set a new base for home prices when these new projects hit the market.

Chart 2: Land Cost Heading Up

Source: URA

Renewed wave of OCR launches

Not only was 2025 a boom year for new home sales, it was also the year the Core Central Region (CCR) made a comeback, marked by a wave of launches that renewed interest in the luxury segment. The momentum is expected to carry through into 2026, with the focus shifting towards the OCR market.

All in, we expect around 18 project launches in 2026, yielding approximately 9,500 private residential units. In addition, up to five Executive Condominium (EC) projects could be launched, adding another 2,300 units to the pipeline. Of these, nine projects are located within the OCR, while the Rest of Central Region (RCR) and CCR could see around four and five launches, respectively.

With so many choice projects in the pipeline, particularly in the OCR, new home demand is expected to remain driven by HDB upgraders. That said, another key factor shaping home sales is interest rates. In the following section, we explore why we believe rates will continue to ease, lending further support to market momentum.

Figure 1: 2026 New Launches

Source: ERA Project Marketing

Stable (markets) gallop ahead as interest rates ease, spurring transactions

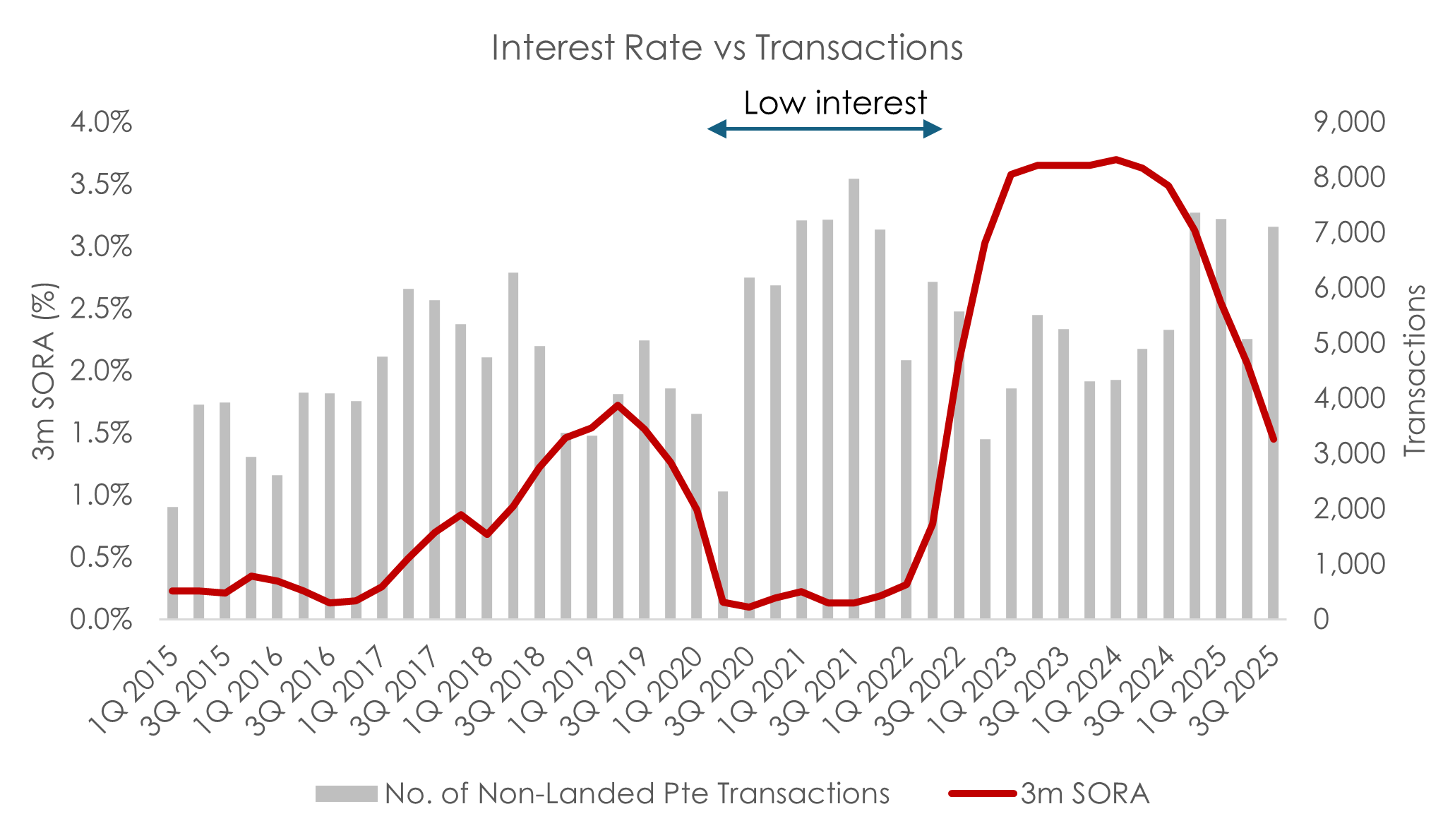

The Federal Reserve’s (Fed) first rate cut in September 2024 offered the residential market a much-needed reprieve. Since then, the market never looked back, strong sales were buoyed by strong positive sentiment, a series of new home launches and lower borrowing costs, even in the face of watershed events like the “Liberation Day”.

New home sales in the first ten months of 2025 have surpassed 10,000 units, the highest level since 2021, while secondary market transactions remained steady at around 12,000 units over the same period.

Given the heightened economic uncertainty, analysts polled by CME FedWatch expect the Fed to keep interest rates low over the next 24 months. Broadly speaking, this could continue to encourage homebuying activities and help sustain transaction momentum even as broader economic headwinds persist.

Chart 3: Interest rate versus transactions

Source: URA, MAS

Expect volatility

Consolidating all we have discussed, 2026 may be shaping up to be another promising year for Singapore’s residential market, barring any unforeseen headwinds. Demand fundamentals remain strong, anchored by steady employment, rising incomes, and resilient household balance sheets. However, geopolitical headwinds could introduce bouts of volatility in the near term.

While sentiment in the market is healthy, it is important for buyers to stay measured. Buyers may wish to review opportunity with prudence, even as upcoming launches in well-connected, amenity-rich neighbourhoods are expected to draw healthy interest.